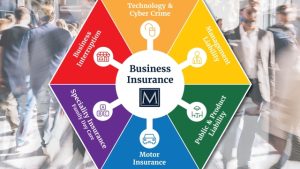

Are you a business owner in California? If so, then securing your business with the right commercial insurance is essential. Commercial insurance provides protection for various aspects of your business, such as liability, property damage, and even employee injuries. It is crucial to have a comprehensive understanding of commercial insurance to ensure that you are adequately covered and prepared for any unforeseen events that may occur.

When it comes to operating a business in California, there are specific insurance requirements that you need to be aware of. Understanding the intricacies of commercial insurance in California can be overwhelming, especially with the different types of coverage options available. As a restaurant owner, for example, you will need to look into restaurant insurance to safeguard your establishment and assets from potential risks.

One essential component of commercial insurance in California is commercial auto insurance. If your business involves using vehicles for operations, it is crucial to have the appropriate coverage to protect your company’s assets and the safety of your employees. Having a clear understanding of commercial auto insurance, as well as the specific requirements in California, is vital to ensure compliance and complete protection.

In this guide, we will demystify commercial insurance in California, with a particular focus on restaurant insurance and commercial auto insurance. We will explore the key coverage areas that every business owner should consider, as well as the specific California requirements for these types of insurance. By the end of this article, you will have a clearer understanding of how commercial insurance works and the steps you can take to secure your business effectively.

So, let’s dive in and unravel the world of commercial insurance in California, starting with restaurant insurance and commercial auto insurance.

Understanding Commercial Insurance in California

Commercial insurance is a crucial aspect of protecting your business in California. It provides coverage for various risks and liabilities that your business may face, offering financial security and peace of mind. Whether you own a restaurant, operate commercial vehicles, or run a business in any other sector, having the right commercial insurance is essential.

One particular type of commercial insurance that business owners in California should consider is restaurant insurance. This specialized coverage is designed specifically for the unique risks faced by the food service industry. It includes protection against property damage, liability claims, employee injuries, and other potential risks that can impact your restaurant’s operations and reputation.

If your business relies on vehicles for commercial purposes, such as delivery services or transportation of goods, commercial auto insurance is a must. In California, commercial auto insurance offers coverage for vehicles that are used primarily for business purposes. This coverage helps protect your business against damages, injuries, and liabilities resulting from accidents involving your commercial vehicles.

Commercial insurance in California provides comprehensive protection for businesses, ensuring that they can weather unexpected events and continue operations smoothly. It is important to understand the specific insurance needs of your business and seek appropriate coverage that aligns with your industry. By investing in the right commercial insurance policies, you can safeguard your business and focus on its growth and success.

Professional Liability Insurance in California

Securing Your Restaurant with the Right Insurance

Running a restaurant in California can be a rewarding experience, but it’s important to protect your investment with the right insurance coverage. Commercial insurance for restaurants is specifically designed to mitigate risks that are unique to the foodservice industry. With the right insurance policy in place, you can have peace of mind knowing that your business is protected against unexpected events.

One key aspect of securing your restaurant is obtaining the appropriate restaurant insurance in California. This type of coverage typically includes property insurance, which protects your physical assets such as the building, equipment, and inventory. This coverage can be vital in case of fire, theft, or other unforeseen events that could result in significant financial losses. Additionally, it’s important to consider liability insurance, which can help protect your restaurant in case of lawsuits due to injuries or property damage that may occur on your premises.

Another important aspect of protecting your restaurant is having commercial auto insurance in California. If your restaurant operates delivery vehicles or provides catering services, having the right insurance coverage is crucial. Commercial auto insurance can help cover the costs of vehicle repairs or medical expenses in the event of an accident involving these vehicles. By having the right insurance, you can protect your business from potential liabilities and minimize the financial impact of unforeseen events.

In conclusion, securing your restaurant with the right insurance is essential for protecting your business, its assets, and its reputation. By obtaining restaurant insurance and commercial auto insurance in California, you can help safeguard your investment and ensure that your business can continue operating smoothly, even in challenging circumstances.

Protecting Your Business Assets with Commercial Auto Insurance

Navigating the roads as a business owner in California can come with its fair share of risks. Accidents happen, and if you rely on vehicles for your operations, it’s crucial to protect your business assets with commercial auto insurance.

When it comes to commercial insurance in California, having coverage specifically tailored for your vehicles is essential. Commercial auto insurance provides financial protection against physical damage and liability claims that may arise from accidents involving your business vehicles.

In California, the restaurant industry is booming, and if you own a restaurant, having the right insurance coverage is vital. This is where restaurant insurance in California comes into play, offering specialized protection for your valuable assets. When you have commercial auto insurance as part of your restaurant insurance policy, you can safeguard your delivery vehicles, ensuring that any unforeseen accidents or damages won’t jeopardize your business’s financial stability.

Commercial auto insurance in California goes beyond just protecting your vehicle. It also provides coverage against bodily injury and property damage liability. This means that if you or your employee is involved in an accident that causes harm or property damage, your insurance policy can help cover the medical bills or property repairs, preventing any out-of-pocket expenses that might have a significant impact on your business.

In conclusion, commercial auto insurance is an indispensable component of securing your business assets. Whether you own a restaurant or operate any other business in California that relies on vehicles, having the right coverage can provide you with the peace of mind you need. Don’t overlook the importance of commercial auto insurance, as it acts as a safety net, protecting both your vehicles and your business’s financial stability.

Recent Comments