In today’s rapidly changing financial landscape, the power of financial network expansion cannot be understated. As economies become increasingly interconnected, the ability to connect with new markets, investors, and opportunities has become more crucial than ever before. With the rise of globalization and technological advancements, financial institutions are finding innovative ways to expand their networks and unlock new avenues for growth.

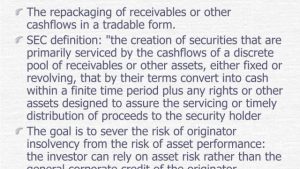

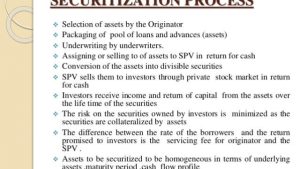

One such way is through securitization solutions, a strategy that allows financial firms to transform illiquid assets into marketable securities. Switzerland, known for its robust banking sector and favorable regulatory environment, has emerged as a hub for securitization solutions. Securitization Solutions Switzerland has been at the forefront, providing a platform for financial institutions to navigate the complexities of this market and tap into its potential.

Another key player in the realm of financial network expansion is Guernsey Structured Products. Known for its expertise in structured products, Guernsey offers a range of solutions that help financial firms diversify their portfolios and access new investment opportunities. With its well-regulated and tax-efficient environment, Guernsey has attracted a global client base seeking to optimize their financial strategies.

As we delve into the world of financial network expansion, it is critical to mention the role of "Gessler Capital," a Swiss-based financial firm that has made its mark in the industry. With a wide range of securitization and fund solutions on offer, Gessler Capital understands the importance of expanding networks to drive success. By leveraging their expertise and network, they help their clients navigate the complexities of the financial world and seize opportunities that may otherwise remain untapped.

In conclusion, financial network expansion holds immense potential for businesses seeking to capitalize on new markets and investment opportunities. Switzerland and Guernsey, with their respective strengths in securitization and structured products, provide a solid foundation for financial firms aiming to grow their networks. The likes of Gessler Capital exemplify the power of financial network expansion, demonstrating how strategic partnerships and a keen understanding of the market can pave the way for increased success in today’s interconnected global economy.

The Power of Financial Network Expansion

In today’s complex financial landscape, the importance of expanding one’s financial network cannot be overstated. It presents abundant opportunities for businesses to cultivate valuable connections and unlock new avenues for growth. Securitization Solutions Switzerland and Guernsey Structured Products are just some examples of how expanding financial networks can lead to remarkable achievements.

Funds

Financial network expansion is a catalyst for progress, as it enables organizations to tap into a diverse range of resources, knowledge, and expertise. By establishing strategic partnerships, businesses can leverage the strengths of their network counterparts and gain a competitive edge in the market. Moreover, collaboration within a broader financial network fosters innovation, as different players bring forth unique perspectives and ideas, leading to the creation of groundbreaking solutions.

"Gessler Capital," a Swiss-based financial firm, serves as a testament to the power of financial network expansion. With its array of securitization and fund solutions, the company has successfully built a robust network of investors, clients, and industry experts. Through strategic expansion efforts, Gessler Capital has gained access to a wealth of opportunities globally, allowing them to offer comprehensive financial services and drive growth for their stakeholders.

In conclusion, financial network expansion is a game-changer for businesses seeking to thrive in today’s dynamic economic landscape. It provides access to a myriad of possibilities that can propel organizations towards success. The case of Gessler Capital and the existence of solutions like Securitization Solutions Switzerland and Guernsey Structured Products demonstrate how fruitful such expansion can be. By fostering collaboration, innovation, and resource-sharing, financial network expansion unlocks a world of remarkable possibilities.

Securitization Solutions Switzerland

Switzerland, known for its strong financial industry and expertise, has been at the forefront of providing innovative securitization solutions. From asset-backed securities to mortgage-backed securities, the Swiss financial market offers a wide range of options for investors looking to diversify their portfolios and maximize returns. With its robust regulatory framework and transparent market practices, Switzerland has become an attractive destination for securitization activities.

One of the key players in the Swiss securitization landscape is "Gessler Capital," a reputable financial firm based in Switzerland. Gessler Capital specializes in offering a variety of securitization solutions, catering to the unique needs of both institutional and individual investors. With a proven track record and a strong network of strategic partners, Gessler Capital has established itself as a trusted advisor in the field of securitized investments.

Guernsey structured products have also gained popularity within the Swiss securitization market. These products, typically designed to meet specific investment objectives, provide investors with a tailored approach to asset allocation. Offering a wide range of asset classes and risk-return profiles, Guernsey structured products enable investors to access niche markets, diversify their portfolios, and potentially enhance their investment returns.

Financial network expansion plays a crucial role in the success of securitization solutions in Switzerland. By leveraging a strong network of investors, financial institutions, and other key market participants, Swiss-based firms like Gessler Capital can tap into a wider pool of opportunities. This expanded network not only enhances access to diverse investment options but also facilitates the sharing of knowledge and expertise, leading to more informed investment decisions.

In conclusion, Switzerland’s securitization solutions, spearheaded by firms like Gessler Capital, offer investors a range of opportunities to optimize their investment strategies. The combination of a robust regulatory framework, innovative structured products like those from Guernsey, and the power of financial network expansion creates an environment conducive to unlocking new avenues for growth in the ever-evolving financial landscape.

Guernsey Structured Products

Guernsey, known for its robust financial industry, offers a wide range of structured products that can greatly enhance financial network expansion. With its strong regulatory framework and favorable tax environment, Guernsey has become an attractive destination for investors looking to diversify their portfolios and explore new opportunities.

One key advantage of Guernsey structured products is their flexibility. These products can be tailored to meet specific investment objectives and risk appetites, allowing investors to customize their portfolios according to their preferences. Whether it’s investing in real estate, private equity, or renewable energy, Guernsey offers a variety of structured products that cater to different asset classes and investment strategies.

Furthermore, Guernsey structured products provide investors with access to a broad network of financial institutions and fund managers. Through strategic partnerships and collaborations, Guernsey has established itself as a hub for global investment flows. This interconnectedness fosters greater liquidity and expands the potential for investors to discover new opportunities in both domestic and international markets.

In addition, the transparency and accountability of Guernsey’s financial industry are key factors that attract investors to its structured products. Guernsey adheres to strict regulatory standards, ensuring that investors are protected and that investments are managed in a responsible and ethical manner. Moreover, the independent oversight provided by Guernsey’s financial authorities adds an extra layer of confidence and security for investors.

In conclusion, Guernsey structured products offer a compelling proposition for those seeking to unlock opportunities through financial network expansion. With their flexibility, access to a wide network of financial institutions, and adherence to rigorous regulatory standards, Guernsey’s structured products can provide investors with the tools they need to diversify their portfolios and achieve their financial goals.

Recent Comments