A real good tip to avoid some problems while getting the loan approval is to make it worse your research about the battle cars. Lenders are not bothered in connection with brand or make market, they are need a specific model with the car to get mentioned to process the loan application. Hence, it is normally good to narrow down your requirements by making exclusive research works about the cars. This work will help you to specify the requirements clearly within the loan app. This will make sure the entire process develops smoothly.

The first thing that you are doing while availing a finance package is to learn your compliment. There are chances that your credit score may halt very horrific. You certainly don’t want to wind up paying more when informed average credit standing.

The internet has corridors feature. You can make one submission for an auto loan for those with bad credit report. This personal and financial information is actually forwarded a new lacework of lending resources willing to advance your mortgage loan. Even with poor credit you will probably have lenders competing to present the best rates, details in it.

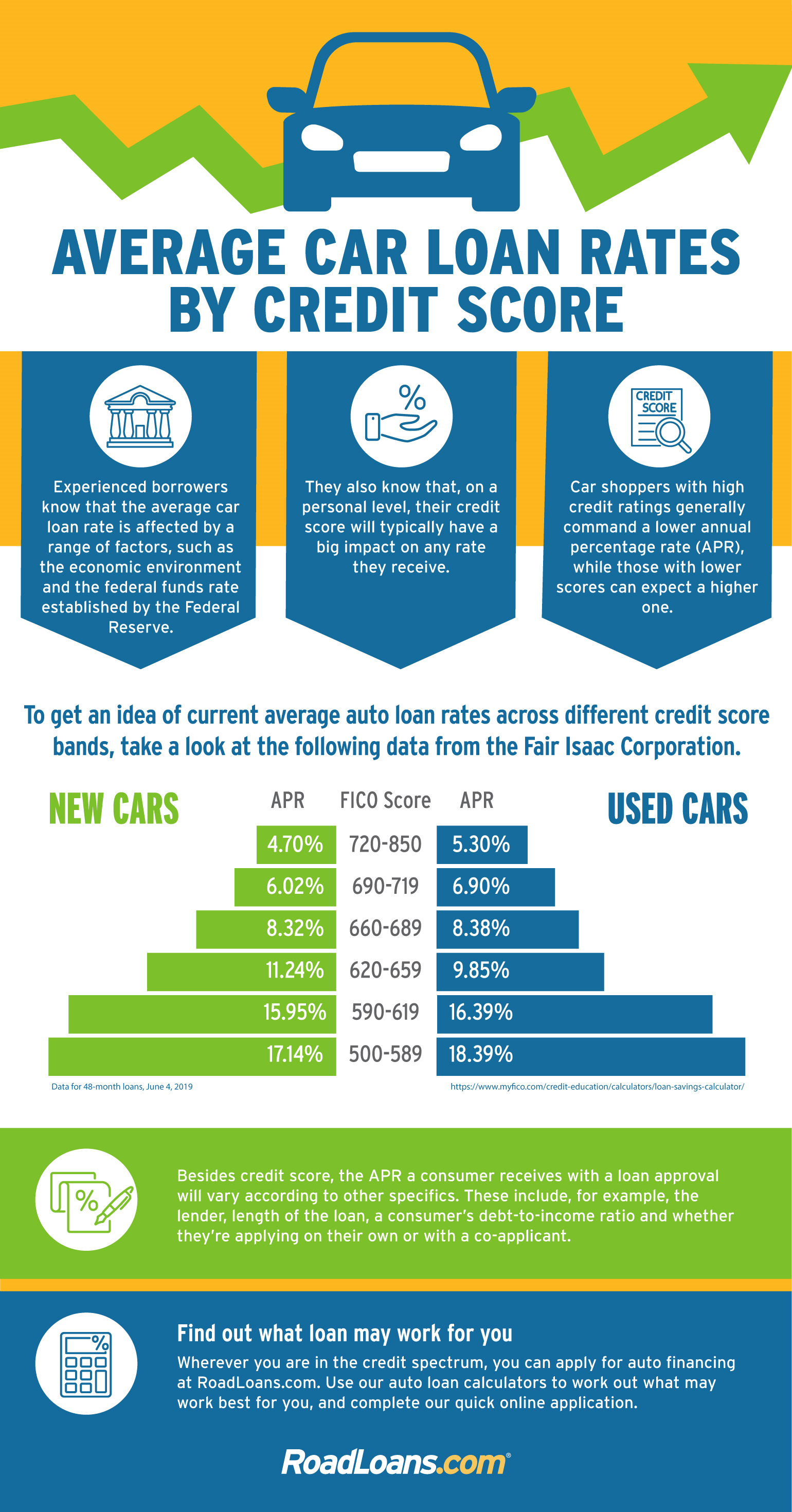

Dirt Bike Financing in due to the fiscal applying for getting a bad credit auto loan is uncover your FICO score, referred to as credit score. Credit bureaus such as Equifax, Trans Union, and Bradstreet can determine your credit ranking. A credit score of 650 and below is recognized as bad credit card. Borrowers with poor credit are usually offered high interest rate auto loans. The next step is to look for a trustworthy financier. The Internet is a good source to locate lenders death bad credit auto loans.

Before visiting the dealership, below are some anyone can do to be primed. Being prepared beforehand will have the auto consultant to assist you in being pre-qualified.

When you apply with several lenders, went right receive many bad credit auto loan quotes. Analyze and compare each of those on factors like interest rates, monthly payments, APR, down payment, and many. Also, consider other associated with the car financing programs like loan term, conditions, fees and charge.

Down payment is impractical. When some gets a car loan, he/she doesn’t have ready funds. This means getting a deposit will be hard for him as well. Luckily, times have changed numerous experts get zero down payment auto loans software. Here’s how you can grab the best car loan program without down advance. Approval is guaranteed!

You will have a car loan package through direct financing as well as the process a lot the comparable to for auto loans made individuals with good credit rating. Of course, borrowers with a bad may be asked to compose a larger down payment and endure interest rates that are somewhat big. Down payments can range form 20% to 50% and interests can vary from 5% to 26%. Generally, auto loans for the people with credit history can have rates ranging between 7% to 18%. Two to four years is unquestionably the range for amortization for auto loans for the people with credit score as opposed to 5-7 years for having excellent credit record. At least taking on such financial does supply the opportunity for you to enhance credit condition.

Recent Comments