Trading in financial markets offers an exciting opportunity for investors to capitalize on the power of stocks, forex, and cryptocurrencies. As the global economy becomes increasingly interconnected, individuals from all walks of life can now participate in these markets and potentially reap substantial rewards. However, it is essential to approach trading with caution and knowledge, understanding the unique nature and dynamics of each market. In this article, we will delve into the world of trading stocks, forex, and cryptos, exploring their differences, advantages, and how individuals can unlock their potential to pursue financial success. So, whether you’re a seasoned investor or a curious beginner, let’s embark on this journey together and discover the possibilities that lie within these lucrative markets.

Understanding Stock Trading

In stock trading, investors buy and sell shares of publicly traded companies. It is a way to participate in the ownership of businesses and potentially earn a profit. The stock market serves as a platform where buyers and sellers come together to trade stocks.

Stocks represent ownership in a company and are also known as equities. When you buy a stock, you become a shareholder and have a claim on the company’s assets and earnings. The price of a stock fluctuates based on supply and demand, as well as various market factors and news events.

Successful stock trading requires understanding the fundamentals of the companies being traded, analyzing financial statements, and staying updated on market trends. Traders also use technical analysis to study historical price patterns and indicators to predict future price movements.

By participating in stock trading, investors have the opportunity to benefit from price appreciation, dividend payments, and potentially outperforming the overall market. However, it is important to note that stock trading involves risks, and careful consideration of investment goals and risk tolerance is crucial before engaging in any trading activities.

Mastering Forex Trading

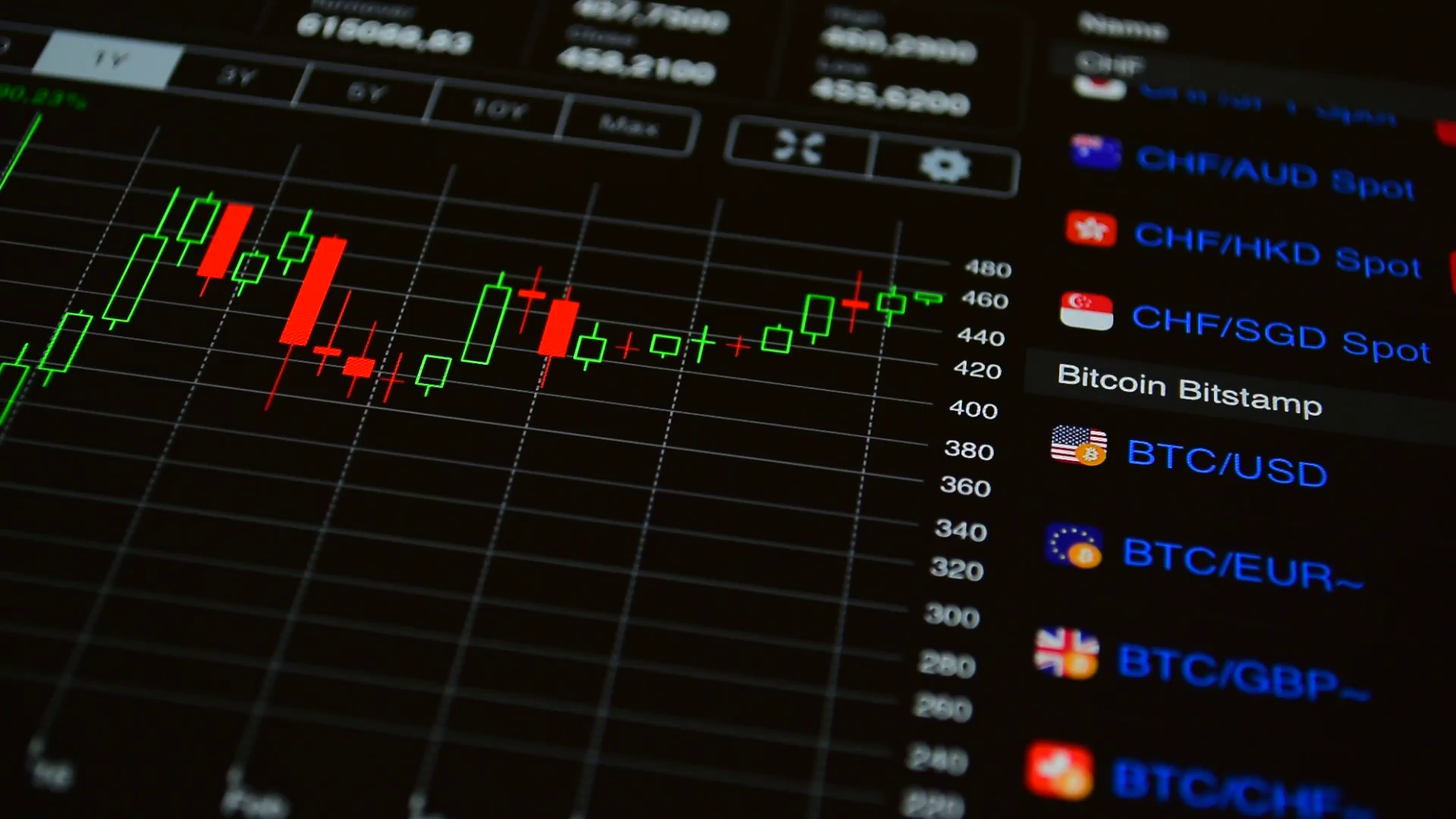

Forex trading, also known as foreign exchange trading, is the process of buying and selling currencies in the global marketplace. As an investor, mastering the art of Forex trading can be a key to unlocking potential financial gains. It requires a deep understanding of global economies and the factors that influence currency exchange rates.

To become a successful Forex trader, it is essential to gain knowledge about the various currency pairs and their respective dynamics. Each currency pair represents the exchange rate between two different currencies. For example, the EUR/USD pair represents the exchange rate between the Euro and the US Dollar. Understanding how these currency pairs fluctuate and the factors that drive their movements is crucial.

Risk management is another vital aspect of mastering Forex trading. The Forex market is highly volatile, and prices can change rapidly. As a trader, it is crucial to set realistic expectations and establish a risk management strategy to protect your investments. This may include setting stop-loss orders, implementing proper position sizing, and diversifying your portfolio.

In addition to technical analysis, fundamental analysis plays a significant role in Forex trading. Fundamental analysis involves evaluating economic data, geopolitical events, and central bank policies to predict currency movements. Being aware of economic indicators, such as GDP growth, employment rates, and inflation, can provide valuable insights into potential currency trends.

Mastering Forex trading requires continuous learning and practice. Traders should stay updated with market news, economic events, and industry trends. Utilizing demo accounts and learning from experienced traders can also be helpful in developing the necessary skills and strategies.

By dedicating the time and effort to understand the complexities of Forex trading, traders can potentially unleash the power of the financial markets and seize opportunities for profitable trades.

Navigating the World of Cryptocurrency

Cryptocurrency has emerged as an exciting and highly volatile investment option in recent years. With its decentralized nature and potential for significant returns, it has captured the attention of traders and investors worldwide.

When delving into the world of cryptocurrency, it is crucial to conduct thorough research and stay updated with the latest trends. Understanding the underlying technology, such as blockchain, is also essential. This technology ensures transparency, security, and immutability in cryptocurrency transactions.

One of the key considerations in cryptocurrency trading is selecting a reliable and user-friendly trading platform. With so many options available, it’s important to choose a platform that offers a wide range of cryptocurrencies and robust security measures to safeguard your investments. Additionally, consider features like real-time market data, customizable trading interfaces, and access to advanced trading tools to enhance your trading experience.

Cryptos

As with any investment, it’s crucial to manage risk when trading cryptocurrencies. The volatility in the crypto market can lead to substantial gains, but it can also result in significant losses. Therefore, setting realistic goals, diversifying your portfolio, and employing risk management strategies are vital to success.

By navigating the world of cryptocurrency with caution, staying informed, and utilizing effective trading strategies, you can potentially unlock the power of this digital asset class and capitalize on its value fluctuations.

Recent Comments